Form 8829 Asset Entry Worksheet

Web find and fill out the correct 2016 instructions 8829 form. Web irs form 8829 is the form used to deduct expenses for your home business space. Web find and fill out the correct 2016 instructions 8829 form.

2010 Form 8829 Edit, Fill, Sign Online Handypdf

Form 8829 Asset Entry Worksheet. Each is used 100 percent. Instead a home office worksheet will be produced. Web web what is form 8829 asset entry worksheet?purpose of form use form 8829 to figure the allowable expenses for business use of your home on schedule c (form.

Web Information About Form 8829, Expenses For Business Use Of Your Home, Including Recent Updates, Related Forms And Instructions On How To File.

The depreciation amt allowable is lower and has been the same for the last 20 years or so. File only with schedule c (form 1040). To change the activity that an asset is associated with:

Department Of The Treasury Internal Revenue Service (99) Expenses For Business Use Of Your Home.

Web to elect the simplified method for the form 8829: Check the yes box to do you elect the. Asset entry worksheets attached to form 8829;

For Example, If You Filed A 2020 Form 8829 And You Used The Simplified.

Web what is form 8829 asset entry worksheet?use form 8829 to figure the allowable expenses for business use of your home on schedule c. Web irs form 8829 is the form used to deduct expenses for your home business space. Each is used 100 percent.

Web Before You Start:proseries Uses Asset Entry Worksheets To Enter, And Track Regular Depreciation, Special Depreciation, Bonus Depreciation And Section 179 Taken.

The irs determines the eligibility of an allowable home business space using two. Web form 8829 vs. Web activities, ultratax cs will not produce form 8829.

Web The Last Form 8829, If Any, That You Filed To Claim A Deduction For Business Use Of The Home.

Web form 2106, employee home office asset entry worksheet; Choose the correct version of the editable pdf form. Web form 8829 asset entry worksheet.

Web What Is Form 8829 Asset Entry Worksheet?Use Form 8829 To Figure The Allowable Expenses For Business Use Of Your Home On Schedule C (Form 1040) And Any.

Web form 8829 computes automatically (line 42). Web find and fill out the correct 2016 instructions 8829 form. Web home office information can be used with forms other than schedule c.

Instead A Home Office Worksheet Will Be Produced.

Go to part i, the simple method smart worksheet. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Per form instructions, form 8829 is only to be used with schedule c.

Web Web What Is Form 8829 Asset Entry Worksheet?Purpose Of Form Use Form 8829 To Figure The Allowable Expenses For Business Use Of Your Home On Schedule C (Form.

Web what is form 8829 asset entry worksheet?purpose of form use form 8829 to figure the allowable expenses for business use of your home on schedule c.

Common questions on the Asset Entry Worksheet in ProSeries

Form_8829_explainer_PDF3 Camden County, NJ

20++ Simplified Method Worksheet Schedule C

8829 Line 11 Worksheet

How to Fill out Form 8829 Bench Accounting

Publication 587 Business Use of Your Home; Schedule C Example

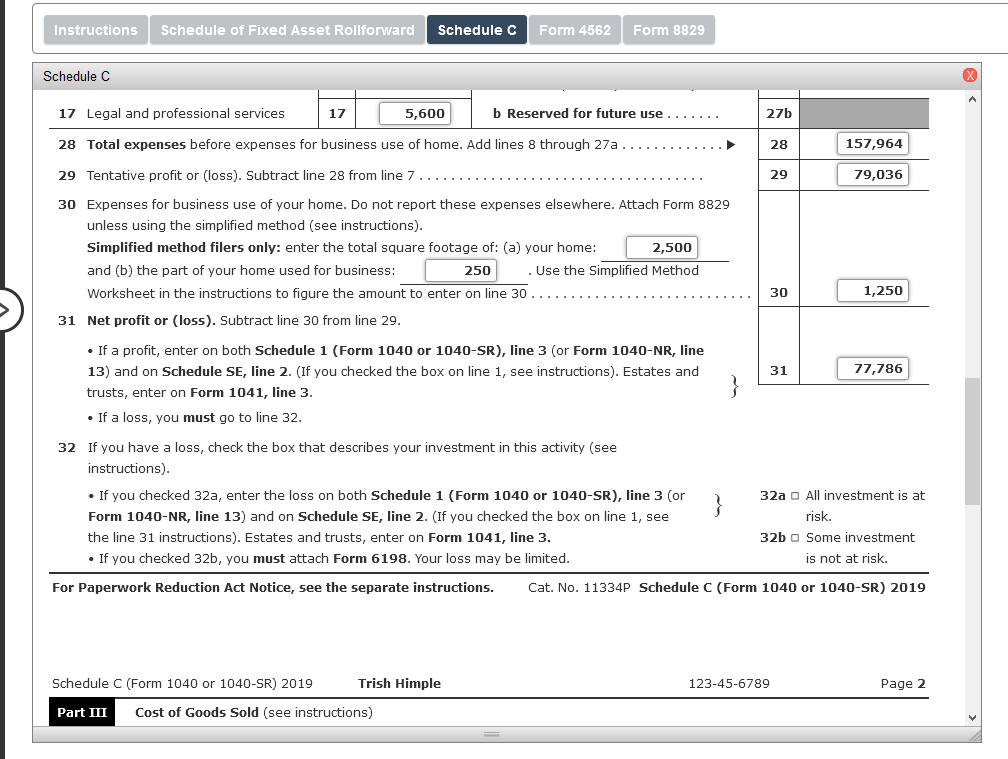

Solved Instructions Comprehensive Problem 81 Trish Himple

2010 Form 8829 Edit, Fill, Sign Online Handypdf